In this edition of the Wise Investor newsletter, we are going to talk about a Canadian trucking and logistics behemoth.

Introduction

TFI International is a North American leader in the transportation and logistics industry, operating across the United States and Canada through its subsidiaries. TFI International creates value for shareholders by identifying strategic acquisitions and managing a growing network of wholly-owned operating subsidiaries. Under the TFI International umbrella, companies benefit from financial and operational resources to build their businesses and increase their efficiency.

TFI International has the following business segments:

Package and Courier ("P&C")

Less-Than-Truckload (“LTL”)

Truckload (“TL”)

Logistics

Seasonality of operations

The activities conducted by the Company are subject to general demand for freight transportation. Historically, demand has been relatively stable with the first quarter generally the weakest. Furthermore, during the harsh winter months, fuel consumption and maintenance costs tend to rise.

Equipment

The Company has the largest trucking fleet in Canada and a significant presence in the U.S. market. As at December 31, 2022, the Company had 11,442 tractors, 38,091 trailers and 6,905 independent contractors.

Facilities

TFI International’s head office is in Montréal, Québec and its executive office is in Etobicoke, Ontario. The company had 544 facilities as of December 2022.

Customers

The Company has a diverse customer base across a broad cross-section of industries with no single client accounting for more than 5% of consolidated revenue.

Growth Strategy

Over the last several years TFI’s growth strategy has been to acquire and assimilate profitable trucking and logistics companies. While doing so TFI makes sure the existing management is not replaced.

To quote its website:

A key part of our growth strategy is to acquire well-managed companies that are leaders in their market. We generally retain existing management and provide them with the requisite tools and support to excel. Our strategy is focused, disciplined, highly developed and proven.

Businesses under consideration must meet strict standards and be accretive to our financial performance in the near term. They must have demonstrable value in expanding our portfolio of companies by increasing our geographic reach, by providing complementary services, or by improving market penetration. Our preference is to acquire asset-light operations.

Smart, strategic acquisitions have been the key to our growth, expanding our reach, increasing our route density, and enhancing our capability to serve a large variety of customers, thereby promoting new platforms for further growth and strong shareholder returns.

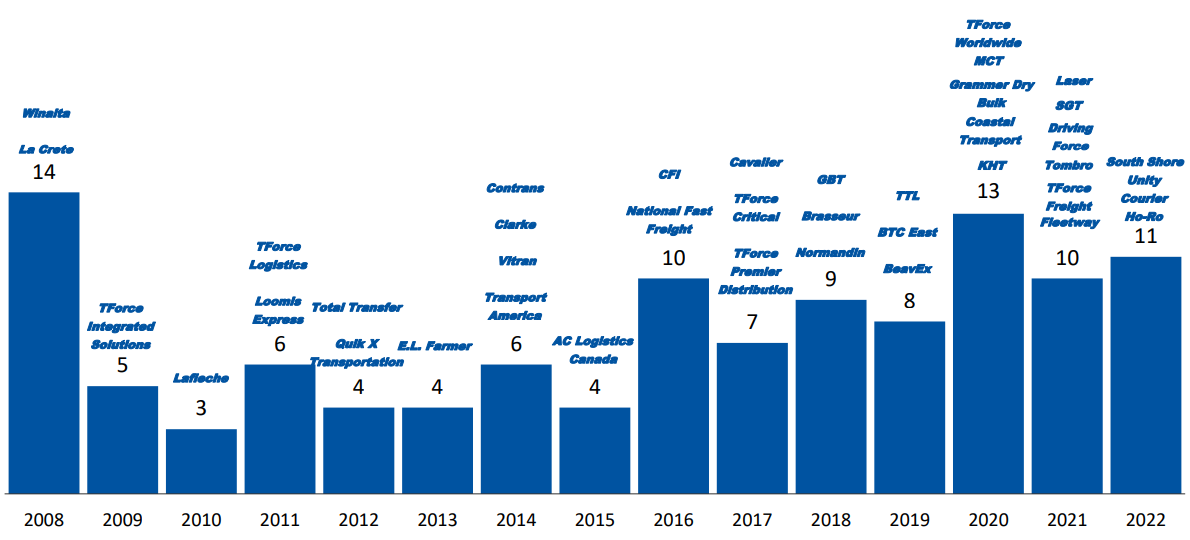

In line with its long term growth strategy, TFI acquired not 1 or 2, but a total of 11 companies in FY 2022.

And it has acquired and integrated a total of 114 companies since 2008.

Business Divisions

As noted earlier, TFI has 4 main business divisions:

Package and Courier ("P&C")

Less-Than-Truckload (“LTL”)

Truckload (“TL”)

Logistics

Most of the divisions provide services across US and Canada.

It derives an almost equal share of revenue from both countries, with 45% coming from Canada and 55% coming from the US.

Package and Courier (P&C)

This business provides next-day services in Canada and globally via its partnership with DHL.

It accounted for 7% of FY 2022 revenue.

Less than Truckload (LTL)

This business provides over the road and asset-light intermodal LTL services.

Major presence in both US and Canada.

It accounted for 45% of FY 2022 revenue.

Truckload (TL)

This business provides dry van full truckload services.

Services are provided on Flatbed, tanks, dumps, oversized and specialized trucks.

Majority of the trucks are owned and have long established partner carrier relationships.

It accounted for 28% of FY 2022 revenue.

Logistics

This business provides same day parcel delivery across US and Canada.

It also provides truck brokerage and other logistics services.

It accounted for 20% of FY 2022 revenue.

Business Insights

Resilient Margins

TFI International has been able to maintain and grow its margins over the last couple of years. But the growth in margins could be attributable to lower fuel costs in last few years.

Ecommerce in Demand

For TFI, E-Commerce seems to be major driver of revenue growth, driving new shipping demands including greater emphasis on last-mile logistics.

TFI serves a vast e-commerce network spanning nearly 80 north american cities.

FY 2022 Total Canadian E-Commerce revenue: US$189.8 million

FY 2022 Total U.S. E-Commerce revenue: US$415.9 million

Acquisition Track record

TFI has acquired 114 companies across highly fragmented markets since 2008.

Capital allocation strategy

As per its 2022 investor day presentation, TFI has the following capital allocation strategy.

Financial Numbers

TFI International is one of the few Canadian companies that can boast of good financials.

Income Statement

TFI has registered tremendous income and profit growth since 2013 thanks to its prudent capital allocation in acquiring profitable companies with quick payback.

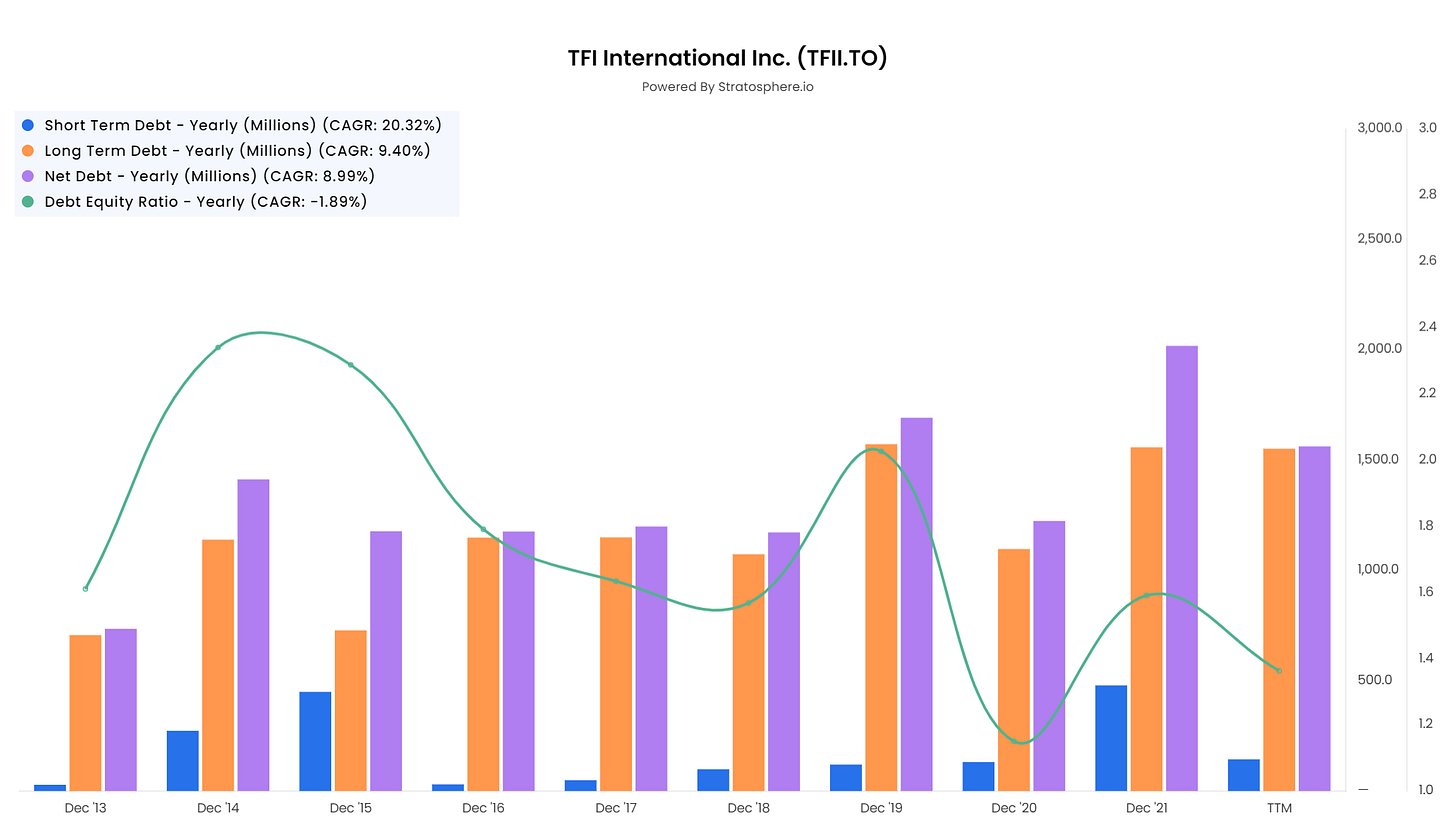

It also kept its debt levels under control which can be seen from the nearly flat interest expense.

Balance Sheet

TFI International has been able to keep its short term debt under control. The long term debt and net debt are in good shape, as can be seen from the decreasing debt to equity ratio.

Property plant and equipment has seen consistent rise owing to the many acquisitions completed. While the lesser rise in goodwill is a good sign as it means TFI has mostly acquired companies at low or fair valuations.

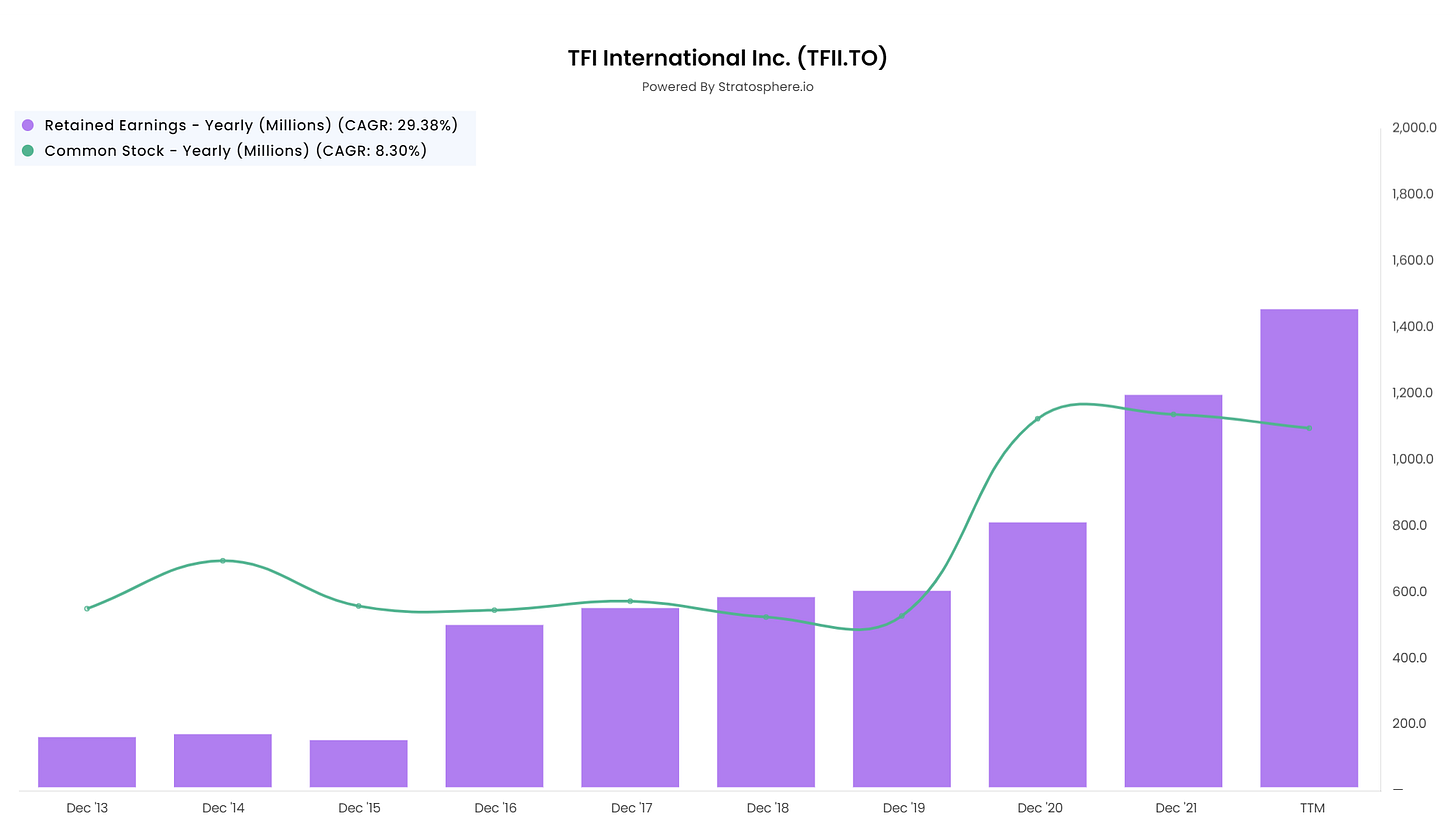

Retained earnings (accumulated cash profits) have grown at almost 30% while common stock has grown at just 8.3%.

Cash Flows

Both operating and free cash flows have grown at 16-17% in the last decade.

Ratios

Price to Earnings - 12

Price to Sales - 1.1

EV/EBITDA - 7.3

Earnings Yield - 8.4%

FCF Yield - 5.5%

ROE - 38%

ROIC - 27%

ROA - 16%

Debt to Equity - 1.2

Interest Coverage - 14

Dividend Payout Ratio - 10.8%

Dividend Yield - 1.4%

Summary

The U.S. attributes up to 10% of its annual GDP to the logistics industry.

The Freight Packing & Logistics Services industry in Canada is estimated to be $2.2bn in 2023.

TFI International is a major player and market leader in most segments.

Based on the business profile and the current financial numbers, TFI International seems to be a good medium term (5 years) bet.

Thank you for reading this article! If you liked it please hit the LIKE button.

I hope you got some value out of this article. Please feel free to share this newsletter.

Disclaimer: Please do not consider this post as an investment advice. I am not a registered financial advisor. Nothing in this article should be construed as an investment advice. Please consult a registered financial advisor before making any investment decisions.

Credits: Most of the content of this article is public information that can be found on news articles, government and company websites.