Is BCE a mouth watering deal right now?

BCE shares are down 30% in the last 1 year. Is it a good time to buy?

If you are a Canadian or have ever visited Canada, you must know that Bell is a household staple in the True North. It is the largest telecom company in Canada and probably has the biggest user base (compared to Telus and Rogers) in Canada as well.

The company commands a nice gross margin of over 65%, which tells me that it has pricing power. And why won’t it? After all its an oligopoly.

The company has been able to reach and cater to the masses via its mid range brands - Virgin Plus and Lucky Mobile. It also owns the popular tech retail store brand - Source.

No one can deny that most of the products and services provided by bell are essential services.

However here is what the company’s stock and dividends returned (CAGR) over the last 15 years. If you have been holding the stock since 2009, you definitely made some good gains.

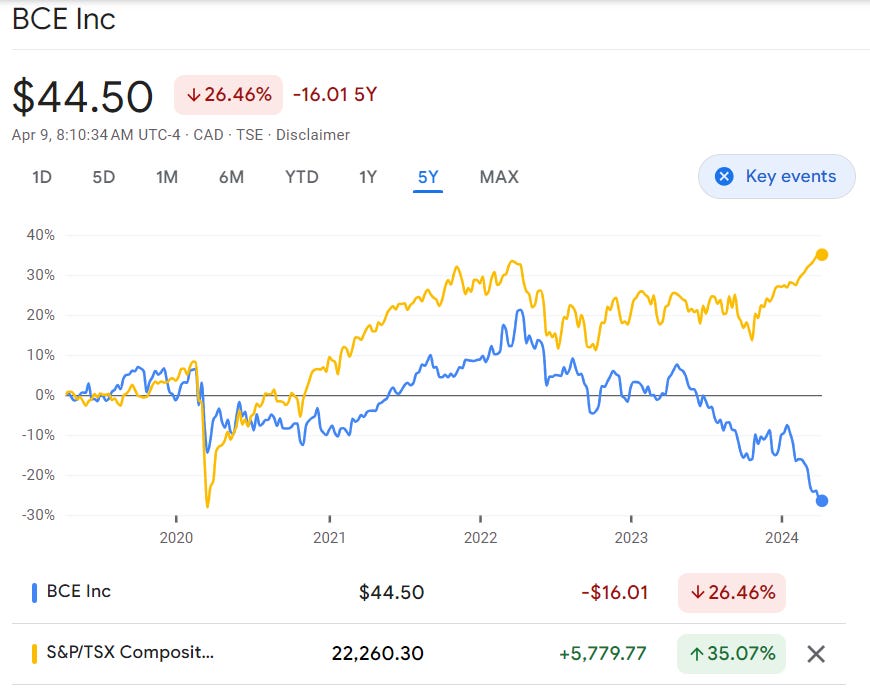

Here’s another comparison:

You would have made much more in the last 5 years if you just invested in a broad Canadian index.

Reasons for under performance

Sales growth has stalled in the last couple of years.

Expenses have gone up.

But most importantly, net income and free cash flow is down.

ROE and ROIC have been declining due to above reasons.

And yet the dividends paid have gone up thanks to the increasing debt.

So is it a good deal?

You probably know the answer.

I posted an article in August 2022 highlighting all of the above points in detail and my decision of not holding a single share of BCE.

Why I think Bell Canada (BCE) is not worth your money

A Little Background BCE is both a wireless and internet service provider, offering wireless, broadband, television, and landline phone services in Canada. It is one of the big three national wireless carriers, with its roughly 10 million customers constituting about 30% of the market.

While I have been an active user of Bell’s products and services, I continue to find that my money is better invested elsewhere and I do not need to “Turn the cash register around” when I can earn more cash than the bills I owe to Bell.

Will I consider BCE in future?

Yes, probably I will if the company can put its house in order by expanding sales, controlling expenses, cutting down the dividends and the debt burden.

All these steps from the BCE management would ultimately lead to better returns for investors. But until then, I am happy to observe from the sidelines.

Disclaimer: Please do not consider this post as an investment advice. I am not a registered financial advisor. Nothing in this article should be construed as an investment advice. Please consult a registered financial advisor before making any investment decisions.

Credits: Most of the content of this article is public information that can be found on news articles, government and company websites.