An interesting global convenience store chain

A fuel and retail convenience giant with over 14000 stores spread across 24 countries

In this edition of the Wise Investor newsletter, we are going to cover one of the global leaders of convenience store industry with its roots in Québec, Canada.

You guessed it.. its none other than Alimentation Couche-Tard.

So grab a cup of coffee and dive in..

Introduction

Alimentation Couche-Tard is a global leader in the convenience sector, operating the brands Couche-Tard, Circle K and Ingo. It strives to meet the demands and needs of people on the go and to make it easy for its customers. To that end, it offers fast and friendly service, providing convenience products, including food, hot and cold beverages, and mobility services, including road transportation fuel and charging solutions for electric vehicles.

Journey so far..

The Alimentation Couche-Tard story started with the opening of its first convenience store by Alain Bouchard in Laval, Québec. Over the next two decades, Alimentation Couche-Tard never ceased to grow, both organically and through acquisitions, and became the leader in the Canadian convenience store industry and a major player in the sector in North America and Europe.

Entry in the United States

Alimentation Couche-Tard made its first breakthrough in the United States in 2001, with the acquisition of 225 Bigfoot stores from the Johnson Oil Company Inc., all located in the Midwest. With a solid management team, one of the best profitability track records in the U.S. convenience retailing industry, and strong growth potential in a booming, highly fragmented market, Bigfoot was a perfect fit for Alimentation Couche-Tard.

Purchase of the Circle K Corporation

In 2003, Alimentation Couche-Tard acquired the Circle K Corporation from ConocoPhillips Company. This transaction significantly grew the Alimentation Couche-Tard network, with the addition of 1,663 Circle K corporate stores located in 16 states and another 627 stores with a franchising or licensing relationship in the U.S. and worldwide.

Expansion into Europe

In 2012, the acquisition of Statoil Fuel & Retail, a leading Scandinavian road transportation fuel and convenience retailer, marked Alimentation Couche-Tard’s entry into Europe. Statoil Fuel & Retail operated a broad retail network across Scandinavia (Norway, Sweden, Denmark), Poland, the Baltics (Estonia, Latvia, Lithuania) and Russia. It has approximately 2,300 stores, the majority of which offer fuel and convenience products while the others are automated (fuel only) stations.

Acquisition of The Pantry Inc.

In 2015, Alimentation Couche-Tard acquired The Pantry Inc., a leading convenience store operator in the southeastern United States and one of the largest independently operated convenience store chains in the United States. The Pantry operated approximately 1,500 stores in 13 states under select banners, including Kangaroo Express, its primary operating banner. The Pantry’s stores offer a broad selection of merchandise, as well as fuel and other services.

Acquisition of Topaz, a leading retailer in Ireland

In 2016, Alimentation Couche-Tard entered the Irish market with the acquisition of Topaz Energy Group Ltd., the leading convenience and fuel retailer in Ireland. The Topaz network is made up of 444 stations across the island of Ireland, more than 30 depots and two owned terminals.

Growth in Ontario and Québec with Esso-branded sites

Alimentation Couche-Tard is always looking for growth opportunities in the Canadian market. In 2016, the company acquired 279 Esso-branded fuel and convenience sites in Ontario and Québec from Imperial Oil Retail. The majority of these sites (229) are located in Ontario, mostly in the Greater Toronto Area. The Québec sites (50) are located in the Greater Montréal Area. The agreement also included 13 land banks and 2 dealer sites, as well as a long-term supply agreement for Esso-branded fuel.

Acquisition in Asia of corporate stores in Hong Kong and Macau

In late 2020, Alimentation Couche-Tard achieved a significant milestone in its growth strategy with the acquisition of Circle K franchise stores in Hong Kong and Macau from Convenience Retail Asia (BVI). This added 341 corporate stores in Hong Kong and 32 franchised sites in Macau to the global network. More importantly, it provides Alimentation Couche-Tard with its long-sought-after platform in Asia from which to launch its regional growth ambitions.

Latest Stats

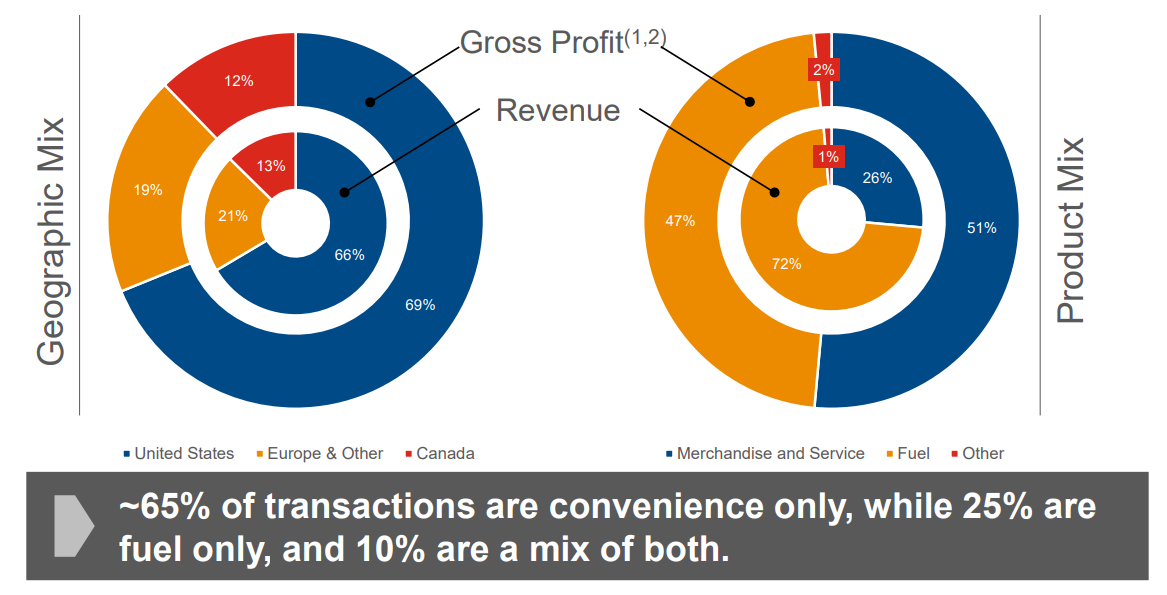

Revenue and Profit Mix

Alimentation gets a majority of its revenue and profits from the US.

It gets most of its revenue from selling fuel, but enjoys a higher profitability from selling convenience items.

US Fuel and Convenience Industry

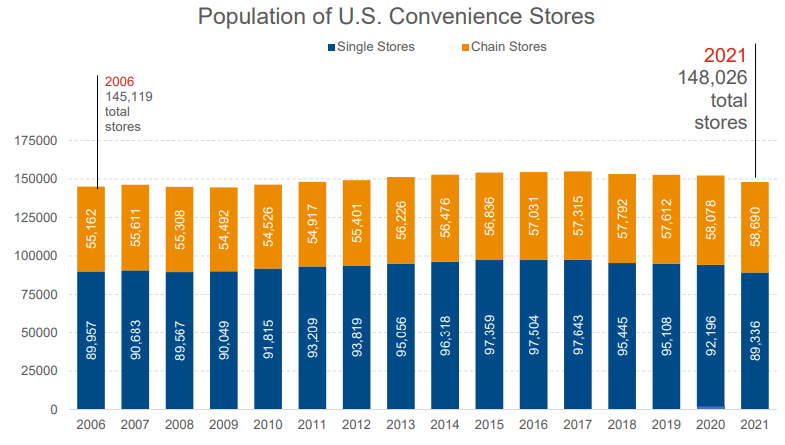

The overall growth in the store count has been very slow in last 15 years, however the share of chain stores has been rising gradually.

Alimentation Couche-Tard’s market share currently stands at ~5% in the US and high fragmentation provides lots of consolidation opportunities.

The industry also seems to be recession proof similar to the grocery retail industry as it sells items of daily need.

Competitive advantages

Significant scale and buying power through broad footprint and global brand

Long-standing cost discipline embedded in company culture and DNA

Proven ability to integrate acquisitions

Solid balance sheet and capacity to invest

Financial Numbers

Alimentation Couche-Tard’s financial performance has been very good over the last decade.

5yr growth

Sales - grew at 10% from $560B to $693B

Operating profit - grew at 14% from $25B to $45B

Net income - grew at 16% from $17B to $34B

Earnings per share - grew at 18% from $1.5 to $3.0

Cash - grew at 18% from $12B to $29B

Net Debt - grew at 1% from $86B to $91B

Operating cash flows - grew at 14% from $26B to $51B

Free cash flows - grew at 30% from $11B to $33B

Dividend payout - grew at 17% from $2B to $4B

Dividend per share - grew at 20% from $0.18 to $0.44

Important Ratios

Gross margins - 16%

Operating margins - 5%

Net margins - 4%

Return on assets - 9%

Return on equity - 22%

Return on capital employed - 15%

Debt/Equity - 0.8

Current ratio - 1.3

Dividend Yield - 0.8%

Future growth

In its recent investor presentation, Alimentation Couche-Tard has indicated that its goal is to double its current EBITDA by focusing on organic growth.

It is looking for a more balanced growth and not looking at too many acquisitions.

It plans to grow by enhancing customer experience, optimize store offerings and opening more stores in the US and Asia markets.

Valuations

This is the most important part of the article, as we need to value Alimentation Couche-Tard based on its financial numbers.

Keep reading with a 7-day free trial

Subscribe to Wise Investor to keep reading this post and get 7 days of free access to the full post archives.